estate tax change proposals 2021

Heres how the Biden administrations recently enacted tax law changesand new corporate and individual tax proposalsdo or could affect taxpayers. Congress is debating two sets of new legislation that would impact the tax on farmer estates and inherited gains indicative of the momentum for changes to the current code for estate gifts and generation skipping taxes.

It May Be Time To Start Worrying About The Estate Tax The New York Times

Potential for foreclosure All financed real estate investments have potential for foreclosure.

. Census Bureau population data along with commercial datasets released this week by U-Haul and United Van Lines. Real Estate Withholding Statement. Illiquidity Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities.

What is the gift tax annual exclusion amount for 2022. The City of Milwaukee offers a variety of properties for sale including fully rehabilitated homes tax-foreclosed buildings vacant lots surplus municipal facilities and brownfield properties suitable for redevelopment. Enter the total amount of estimated tax payments made during the 2021 taxable year on this line.

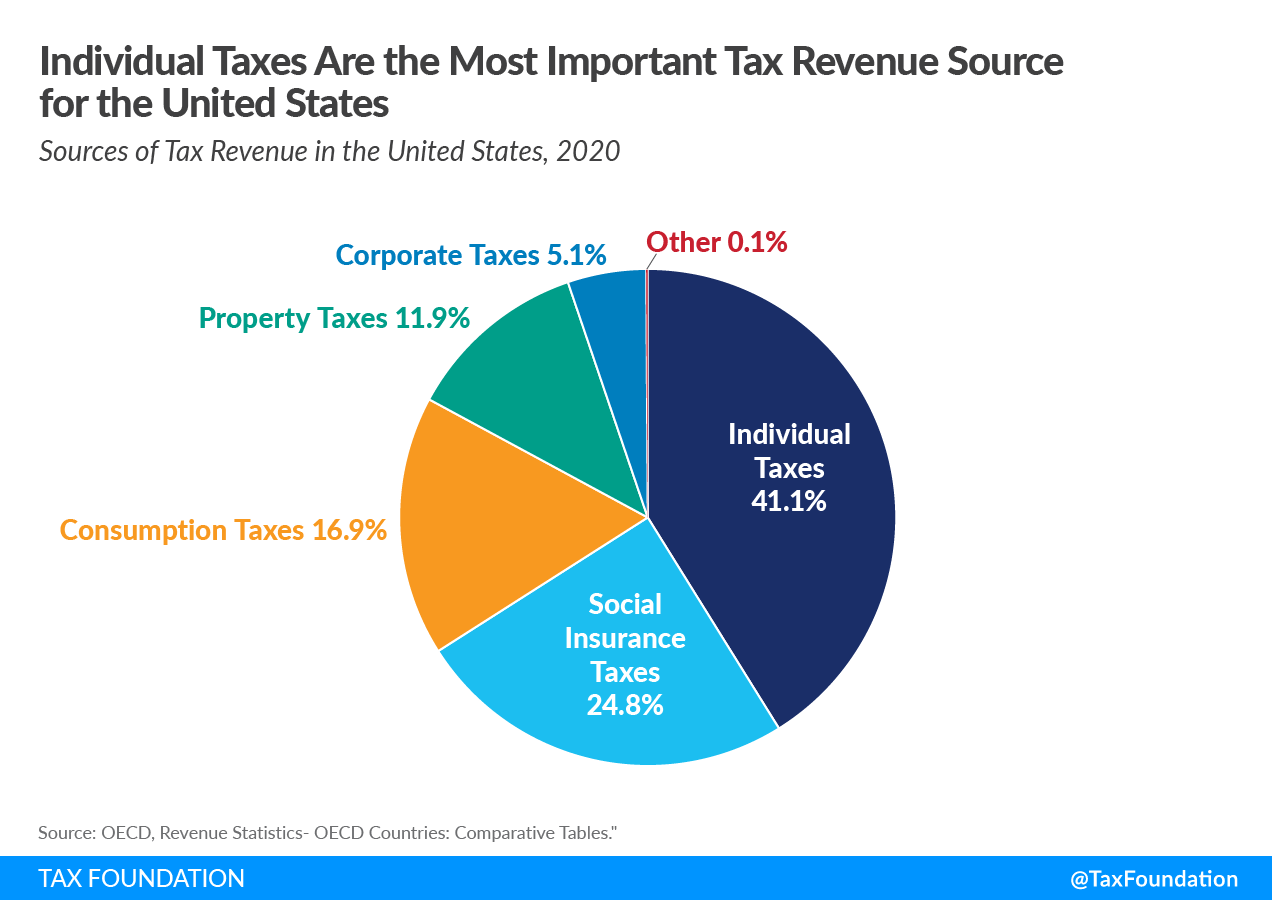

2509 West Capitol Drive Proposals due on or before 1200 pm Monday May 2 2022. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Taxes Due Go to the History section and you will see a break down by tax year.

Proposals due on or before 1200 pm Tuesday May 31 2022. To change to a joint tax return you and your spouseRDP must have. Historic Land Use Investigation.

Real estate unless they file for a withholding certificate prior. A proposed increase in the top ordinary income tax rate from 37 to 396 would be effective starting with the 2022 tax year. Go to Print tax bills section Click on Tax Year.

This change would accelerate the return to a top income tax bracket of 396 rather than waiting until tax years following 2025. Krista Swanson Gary Schnitkey Carl Zulauf and Nick Paulson Krista Swanson The US. Individual Top Marginal Income Tax Rate Increase.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. The current exemption doubled under the Tax Cuts.

An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities. Explore the Housing Help tool to find housing resources you can use if youre a homebuyer homeowner or investor. Detailed Tax Payment Information Go to the History section and click on Tax Year Only tax payments made after September 1 2010 are displayed on.

Economic Development Planning 124 West Diamond Street PO Box 1208 Butler PA 16003-1208 Phone. Both pieces of legislation could have significant impacts for middle. Line 17 Withholding Form 592-B andor 593 Enter the 2021 nonresident or real estate withholding credit from Forms 592-B Resident and Nonresident Withholding Tax Statement or Form 593.

Line 16 2021 Estimated Tax. A Canadian is generally subject to 15 withholding tax on the gross proceeds of US. President Bidens Tax Proposals.

If you do not claim the dependent exemption credit on the original 2021 tax return you may amend the 2021 tax return following the same procedure used to amend your previous year amended tax returns beginning with taxable year 2018. Change the Payoff Month Enter desired monthyear and click on Submit. Check back throughout 2021 for a snapshot of the current tax debate and explore our in-depth analysis of President Bidens FY 2022 budget proposals to learn more about its economic and fiscal impact.

Americans were on the move in 2021 and they chose low-tax states over high-tax ones. 20 Estate taxes reduce the value of an estate before its given to any heirs and the gift tax applies to gifts of money or property of more than 15000 in value Biden would change that to the 2009 level of. The tax rate applicable to transfers above the exemption is currently 40.

509300 452700 and 481000 respectively. Population only grew by 01 percent between July 2020 and July 2021 the lowest rate since the nations. Thats the finding of recent US.

What is the transfer tax exemption for 2022. Sherman Park Neighborhood Commercial Property Listing. The estate and gift tax rate and exemption would go back to 2009 levels making more gifts and estates fall under the higher tax rate.

Property Taxes Property Tax Analysis Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Tax Proposals Comparisons And The Economy Tax Foundation

Build Back Better Act Trusts And Estates

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Tax Proposals Comparisons And The Economy Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

Estate Tax Law Changes What To Do Now

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

It May Be Time To Start Worrying About The Estate Tax The New York Times

The New Death Tax In The Biden Tax Proposal Major Tax Change

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)